Introduction

Who is this guide for?

This guide is for digital artists and designers curious about cryptoart and NFTs.

If you’re reading this, you’ve probably…

heard about Beeple selling an NFT for $69 million dollars at a Christie's auction.

been confused by what NFTs are.

wondered if you could get in on this whole thing before it disappears.

This guide has been intentionally written as a high-level introduction for general audiences.

What this guide isn’t

This is not a technical guide.

I’m not going to explain the details of the technology involved. You can visit the further reading section below if you want to go deep.

If you’re the type of person who likes to start sentences with, “Well, actually…” then this guide is not for you. Please go away.

Cryptopunks, a pioneering NFT project from 2017.

Cryptopunks, a pioneering NFT project from 2017.

Who am I?

I’ve been a designer, technologist, and communicator for over 20 years.

Many guides to cryptoart and NFTs are written by a) groups that stand to benefit from them or b) zealous individuals who drank an entire gallon of crypto kool-aid in one sitting.

I am neither.

I’ll shoot straight, and I’ll skip the jargon and acronyms when I can.

(And trust me: I haven’t been drinking the kool-aid. I find this topic fascinating, but I’m a skeptic—as you’ll see below.)

Disclaimer

I’m not a cryptoart expert. I’m a nerd who saw a need for this guide, and I filled it.

I’ll regularly correct and update this guide, keeping track of major changes and giving credit for contributions in the Changelog below.

✉️ Contact me with questions or ideas. Don’t be shy! I’m nice.

Why did I create this guide?

I don’t know. It was fun? I’m weird.

The basics

What is cryptoart?

There’s no universally accepted definition of cryptoart. For now, let’s use this:

Cryptoart is art that uses blockchain technology in its creation and/or distribution.

Okay, so what is blockchain technology?

Think of blockchains as giant spreadsheets1 that can be viewed by anyone. I know: Boooring!

But wait! These spreadsheets have ✨special rules✨.

You’re not allowed to delete or change rows in the spreadsheet.

You can only add a new row after the last row. (Weird, right?)

When you add a row to the spreadsheet, a network of computers do a bunch of super complex math to confirm that what you added is okay. (Even weirder.)

If you try to sneak a change into the spreadsheet—like, I don’t know, give yourself a million bucks—that change will be rejected by the network.2

Just like normal spreadsheets, blockchains are great for keeping track of transactions.

Um… transactions?

Yeah, you know: I give you something, you give me something in return. Transactions.

Blockchains store transactions in a way that is viewable by anyone but editable only under certain conditions.

(See the special spreadsheet rules above, in case you already forgot them.)

What are NFTs?

Now we’re getting to the juicy stuff. 🍋

NFT stands for Non-Fungible Token. But what does that mean?

Don’t worry about it. Seriously. Other guides try to explain fungibility, but I’m not going to. It’s boring and too technical for our purposes.3

The keyword to remember is token. We’ll come back to it in a minute.

For now, let’s think of NFTs as digital collectibles. In the real world, pretty much anything can be collectible, given the right conditions: stamps, books, Pokémon cards, spoons.

(No really, people collect spoons.)

The same is true in the digital world. NFTs are a blockchain technology that allow people to collect and trade just about anything, including… wait for it… art.

This terrible thing, which I created in five minutes, could totally be an NFT.

This terrible thing, which I created in five minutes, could totally be an NFT.

Theoretically, NFTs can be used for lots of other stuff, too: issuing movie tickets, selling video game items, or even proving ownership of real estate.

But let’s stay focused: we’re talking about digital art here.

What is “digital art”?

Oh no, we’re not going down that rabbit hole.

You’ll have to define digital art for yourself. Whatever definition you have in your head is probably good enough for our purposes.

Let’s keep moving.

How are NFTs made?

There are two basic steps to creating an NFT:

- Make a thing.

- Tokenize the thing.

1. Make a thing

NFTs start as digital art (i.e. stuff you already know how to make):

- still images

- GIFs

- video loops (with or without audio)

- music

“What about physical art? Can’t I turn a sculpture or a painting into an NFT?”

Kind of. It’s trickier than you think. We’ll get to it in a second.

(If you really can’t wait, jump ahead. But don’t get mad at me if you’re confused.)

2. Tokenize the thing

Remember earlier that we said NFTs are tokens? Follow along:

For our purposes, think of a token as a digital link to something you’ve made.

Tokens live on blockchains, which we’ve already established are great for keeping track of transactions.

When you “tokenize” a digital artwork, you’re linking something you’ve made to a blockchain, which can be useful for proving ownership of that thing (among other things).

“Wait, there are multiple blockchains?”

Oh yeah, there are loads of blockchains. You can even create your own.

For NFTs, Ethereum is currently the most popular blockchain.4

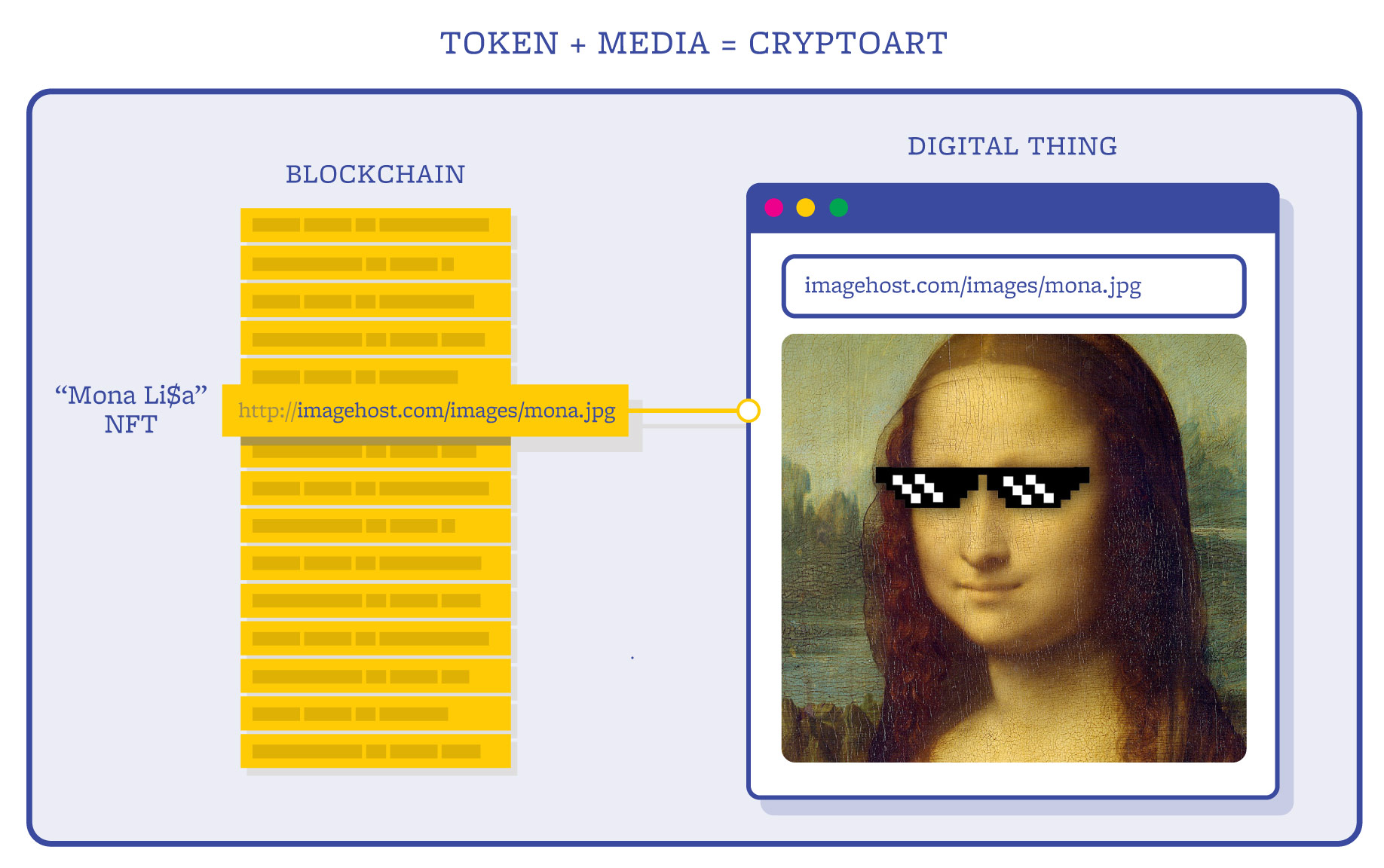

Token + media = cryptoart

This is important: the token by itself is not cryptoart.

The NFT (remember: T is for token) merely points to something else and says, “Hey, this thing and I are joined at the hip. We’re inseparable. Think of us as one.”

Token + media = cryptoart

Token + media = cryptoart

How do you link a token to a digital thing?

Typically, you link a token to a digital thing you’ve made by attaching some extra information (metadata) to the NFT. That extra info includes a link to an image, video, GIF, song, etc. that’s hosted somewhere else.5

This arrangement begs a few questions:

- Where will the “official” digital asset be hosted?

- How can collectors ensure that the asset won’t be changed by the artist?

- What happens if the asset host goes down? Or disappears?

There are solutions to these problems in the works,6 and some of them get technical pretty fast7. This topic goes beyond the introductory level, so let’s keep moving for now.

Understanding “ownership”

“If the NFT isn’t the actual image, animation, music, etc. that I created, can’t people just copy my artwork?”

Remember: The complete cryptoart is the token and the media you created. So they can copy your image or your GIF or whatever… but it doesn’t really matter.

Depending on how you see things, this is either great news or a big problem.

(By the way, the inherently copiable nature of digital art is the #1 thing I see NFT newbies struggling with—and for good reason. It’s confusing.)

Okay, let’s work through this together.

An NFT says that one specific copy of your digital media—the one listed in the NFT’s metadata—is the one that matters.

We discussed this above. If you missed it, go back and make sure you understand it before moving on.

So you could have literally millions of copies of your sweet CG teapot floating around the web, but the owner of your cryptoart only cares about the “official” copy linked to the NFT.

“I’m sorry, but that’s insane.”

At first blush, I agree. But let’s step back for a second.

For a few bucks, you can find and print a high-resolution copy of Cindy Sherman’s “Untitled #96.” Here’s a copy of it right here:

*“Untitled #96” by Cindy Sherman (1981)*

*“Untitled #96” by Cindy Sherman (1981)*

In 2011, a print of that photograph sold for $3.89 million USD during a Christie's auction—setting a record for the most expensive photo ever sold (at that time).

Then, as now, people could easily reproduce the photo. Somehow, though, this didn’t stop the photo from selling for a boatload of cash.

“That’s different. People were buying one specific print of the photograph, one created by the artist. And it was a print of the highest quality.”

What if we broke into Cindy Sherman’s private studio, stole the original negative of the photograph, and then produced a print that was identical in quality to the one sold during the 2011 auction?

Would we be able to sell it for the same amount? Or more?

“No.”

Why not?

“It wouldn’t be official. It wouldn’t be from the artist.”

Ah! Interesting. So we need to be able to trace the print back to the artist somehow?

“Okay, I see where you’re going. An NFT traces the official artwork back to the artist, and the blockchain can show all the subsequent owners, including the current one.”

Exactly.

“But what if we hung our copy right next to the official print in an identical frame?”

It wouldn’t matter.

“What?! Yes, it would! You wouldn’t be able to tell them apart.”

The owner would know that the official version is the one in that exact spot on the wall, in that specific building.

It’s the same with NFTs: They point to a specific copy of a digital artwork “hanging” in a specific place on the internet.

“I still think it’s crazy that people can copy my images. That devalues the art!”

Maybe. But it doesn’t always work that way.

I bet your mother or your uncle has a magnet on their refrigerator of one of Monet’s famous Water Lilies paintings.

Amazon currently returns nearly 800 items when you search for “Monet Water Lilies,” including neckties, mouse pads, and face masks.

A horrendous idea for a face mask. And yet, there it is.

A horrendous idea for a face mask. And yet, there it is.

Despite these countless copies, Monet’s Water Lilies paintings routinely fetch tens of millions of dollars at auctions.

Perhaps the prevalence of reproductions in our culture has woven the paintings into our collective consciousness.

Perhaps this has only driven up the value of the originals. Perhaps owning a Water Lilies painting is like owning a piece of western civilization.

“That’s only because the originals are scarce.”

There were about 250 paintings in the Water Lilies series.

“Still, they’re very difficult to forge.”

Difficult, but not impossible.

“The difficulty of copying them is what makes them valuable. If everyone could create convincing copies of the original, the originals would go down in value.”

Would they?

We established above that the we’d have records of the sale and location of each bona fide painting.

We’re stretching this analogy a little too far, but: We’d know that the originals are in Paris or New York or locked away in a dark warehouse somewhere, not resting on the mantle in your uncle’s basement.

Creating physical objects

At some point, many artists get deeply confused and/or frustrated by all the above and come to the inevitable conclusion:

“Fine, I’ll just make physical versions of my work. People can’t copy those, and it’s way more special anyway!”

This idea is becoming increasingly popular, which is why it gets its very own section. 😎

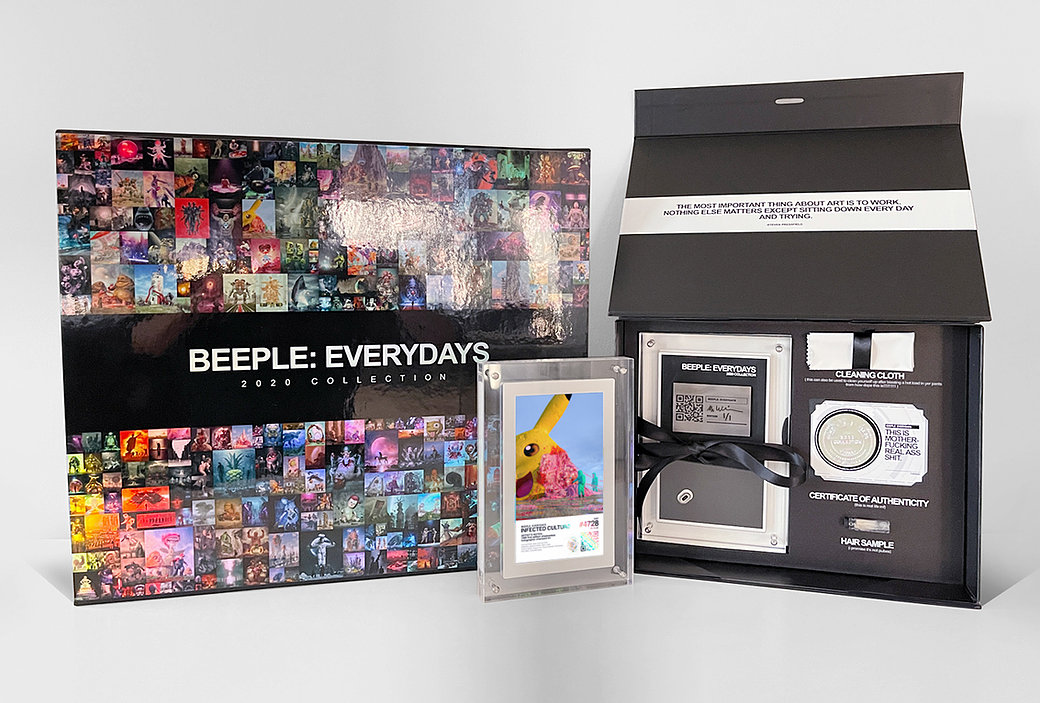

The physical product that owners of Beeple’s 2020 collection will receive

The physical product that owners of Beeple’s 2020 collection will receive

- In one of Beeple’s recent auctions, he delivered digital frames to collectors in attempt to link a physical object to the digital images he creates.

- Neil Stubbings created an impressive physical version of his NFT animation, “Drunk'n Steamboatin'”

- There are several options for displaying NFTs, including ZendVibes, Infinite Objects, and Meural.

- Aisthisi is combining digital art, NFTs, and Greek olive oil. Yes, I said Greek olive oil.

The notion of creating a physical component to accompany a digital collectible makes sense. It seems to address the issues around ownership and “copyability” discussed above.

At the same time, it allows collectors to display something physical on their shelf.

It’s a win-win situation, right?

Unfortunately, that’s not how NFTs work (yet)

While there is nothing stopping you from creating physical companions to digital works, it’s important to understand the ins and outs of that decision.

Physical stuff can be hard to tokenize

We’ve already discussed that NFTs are merely pointing to assets. NFTs are not the things themselves.

This is my idea of a joke. I’m fun at parties, I swear.

This is my idea of a joke. I’m fun at parties, I swear.

If you create a sweet CG teapot and then decide to bundle it with an equally sweet 3D-printed version of the teapot, you need to think about a few things:

How will you link the NFT to the physical object? (You can’t just create a “link” to it, since the physical object isn’t “hosted” anywhere in particular.)

How do you ensure that the physical object is the official version and not an unauthorized copy?

How do you keep others from creating fake tokens that claim to be the official token for your physical object?

These are deep waters.

There’s a lot of work being done in this area, but the takeaway for now: there isn’t an easy, bulletproof way to link an NFT to both a digital and a physical object.8

NFTs move fast, physical stuff doesn’t

NFTs can change hands hundreds of times in a few minutes.

A big part of what has made NFTs popular is that people trade them on markets the way they would trade stocks, which can quickly drive up (or down) their value.

When you link a physical object to your NFT, you’re shackling a bowling ball to a cheetah.

- How is the ownership of the physical object going to change hands?

- Who will keep track of where it should be shipped?

- Who will pay for that shipping?

- How do you accurately keep track of the object’s current location?

Not your problem?

The response I usually hear from creators to these questions is: “People will figure it out.” Or, to put it another way: “It’s not my problem.”

But when a new owner goes to their mailbox looking for the physical object that was supposed to come with their NFT, who will they turn to it when they find their mailbox is empty?

On blockchains, identities are obscured. The only identity that is easily traceable is—you guessed it—the artist’s. Based purely on the blockchain, there’s no way for a new buyer to even contact a previous owner.

This doesn’t mean you, as the original creator, are necessarily liable for anything, but it might mean you get a lot of confused and/or angry folks banging on your inbox and/or threatening legal action.

Ownership of physical stuff is different than ownership of digital stuff

Compared to the relatively young laws governing digital property (good luck even defining “digital property”), the laws governing physical property go back to Ancient Times™.

To make matters worse, those laws differ around the world, nation by nation, state by state, and even county by county (at least here in the USA).

NFTs were built for the decentralized, relatively lawless world of digital ownership. Duct-taping ownership of a physical object onto an NFT is uncharted territory, legally speaking.9

Proceed at your own risk.

You can’t stop separation

There’s nothing stopping buyers from selling your digital and physical assets independently.

Arguably, they wouldn’t want to separate the two assets, since they’d have greater value as a set. And yet, people do weird things all the time. 🤷

How can I make my own NFT?

Thanks to the burgeoning NFT scene, there are a growing number of tools and platforms that allow you to tokenize (or “mint”) your own NFTs with just a few clicks.

The general steps

- Set up a digital wallet.

- Add Ether (ETH) to your wallet.

- Choose a platform.

- Eat a pickle.

1. Set up a digital wallet

As in real life, you won’t get far in cryptoland without a wallet. There are roughly a gajillion of them. There are hardware wallets, software wallets, and even paper wallets. 😮

Think of a crypto wallet like a special debit card that allows you to buy and exchange tokens. (And remember: the “T” in NFT is for “token.")

There are many popular wallets for working with NFTs:

My recommendation? Start with MetaMask.

In addition to being an easy-to-use crypto wallet, MetaMask allows you to quickly and securely log in to many popular NFT platforms.10

2. Add Ether (ETH) to your wallet

What good is an empty wallet?

You don’t have to do this right away, but adding Ether—the currency of the Ethereum blockchain—to your wallet is a good way to get to know your wallet. (Yes, I realize that sounds weird.)

How you add Ether will depend on the wallet you’ve chosen. See your wallet’s website for help.

A note for people who live in Texas or similarly backward states:

If, like me, you live in a state that doesn’t allow you to purchase Ether directly through your wallet, you’ll need to buy Ether through an exchange (like Coinbase) and then transfer that money to your wallet.

It’s a slight pain in the butt, but not a big deal. Here's a step-by-step guide.

3. Choose a minting platform

Remember: “minting” is another word for tokenizing your work on a blockchain.

Strictly speaking, you don’t have to use an NFT minting platform to tokenize your artwork.

Maybe you’re super hard-core, and you want to code your own ERC-721 token and deploy it to the Ethereum blockchain all by yourself. But if you’re super hard-core, you probably aren’t reading this guide.

For the rest of us mere mortals, minting platforms make it super easy to create an NFT.

Here are some popular NFT minting platforms with low learning curves:

No free rides on the Ethereum superhighway

Keep in mind that in most cases, tokenizing your art on the Ethereum blockchain will cost a few bucks. Adding stuff to Ethereum requires computing power, and that computing power requires “gas.”

That’s what they actually call it: gas.💨

Just like cars, computers working on the Ethereum blockchain require “gas” to move things around. And just like real gas, it ain’t free.

The high cost of gas on the Ethereum blockchain has become a real problem. In some cases, it can all but kill an otherwise vibrant project or marketplace.11

4. Eat a pickle

I bet you thought “eat a pickle” was code for another confusing cryptoart term.

It’s not. I just really like pickles.

How can I sell NFTs?

Most of the minting platforms (see above) also double as marketplaces. But each marketplace has its own quirks, its own philosophy, even.

It’s not realistic to cover all the cryptoart marketplaces here (new ones are popping up all the time), but let’s look at a few popular ones.12

Rarible

- A beginner-friendly mint-and-market platform

- Open to all (no invite or application required)

- Includes royalty options (when selling on the Rarible marketplace)

- Sell single items or collections

- Items are cross-listed on OpenSea

OpenSea

- Currently the largest NFT marketplace (over 200 categories and 4+ million goods)

- Open to all (no invite or application required)

- Can aggregate NFTs from multiple marketplaces

- True decentralized exchange

NiftyGateway

- Emphasis on timed auctions (“drops”) of collectibles

- Creators choose royalty options (only applies to Nifty marketplace transactions)

- Application required to become a creator (at time of writing)

KnownOrigin

- Curated gallery approach with timed release events (“drops”)

- Application required to become a creator (at time of writing)

SuperRare

- Curated marketplace that functions like an online art gallery

- Application required to become a creator (at time of writing)

MakersPlace

- Timed auctions (drops) and traditional marketplace

- Application required to become a creator (at time of writing)

How do royalties work?

A Garbage Pail Kids collectible powered by the Wax blockchain

A Garbage Pail Kids collectible powered by the Wax blockchain

Perhaps the most exciting promise of NFTs is the support for royalties paid to artists.

In reality, though, there are some caveats.

What are royalties?

In the music industry, if you write a hit song, you’ll get paid every time that song is purchased, licensed, or streamed. Those payments are called “royalties.”

Royalties are typically a percentage of a full transaction amount. For instance, a 5% royalty on a $100 music license would be $5.13

Royalties aren’t natively supported on the open Ethereum blockchain (yet)

At the moment, there’s no built-in royalty system for NFTs on the open Ethereum blockchain14—although there is an interesting proposal in the works.

This means that royalty systems are currently provided by marketplaces that do business on top of the Ethereum blockchain (or other blockchains).

Each marketplace has its own rules and options for setting and paying royalties.

Example time!

- You decide to mint and sell your CG teapot NFT on Rarible.

- When you’re creating your listing, you opt for a 20% royalty. (On Rarible, you can choose whatever percentage you want.)

- A few days later, your item sells for 5 ETH (5 Ether, equivalent to $3,700 USD at the time of writing). NICE!

- You keep all of that money, minus Rarible’s commission fees.

- The following week, the original buyer of your NFT sells it on Rarible’s secondary marketplace for 6 ETH ($4,400 USD). Since you set a 20% commission, you’ll make about $880 on that transaction—even though you were not directly involved in it.

- The next week, the new owner sells your NFT on OpenSea. (All Rarible items can be listed and sold on OpenSea as well.) Unfortunately in this case, you don’t get any royalties. Royalties from Rarible (where you minted) are not currently transferrable to OpenSea. Bummer.

Again, royalty systems differ for each marketplace. Take some time to research each platform before deciding where to sell your stuff.

What about taxes?

Oh boy. Okay. Taxes.

I’m going to preface this by saying I am not a tax professional. It’s on you to research how things work in your region.

In the United States, the way things seem to be working15 is that you are only taxed on gains you make when converting crypto assets back to US dollars.

In this way, money made from selling NFTs is taxed in a way similar to money you make selling stocks or other securities.

Here’s a loose example

- You sell an NFT and make 5 ETH (roughly $3,700 USD at the time of writing)—but you don’t convert it to USD. You let it sit there in your wallet.

- You then use half of that ETH to buy some sweet, sweet Bitcoin (BTC).

- Bitcoin skyrockets in value, and your BTC is now worth $10,000.

- You decide to sell half of your BTC for $5,000 USD, which you then transfer to your bank account.

- Even though the total value of your cryptowallet exceeds $5,000, you will only be taxed on the $5,000 that you made when selling your BTC for USD.

“But isn’t crypto anonymous? How would the government know if I’m making money from it?”

Until we convert to a 100% crypto economy, any money you make from cryptoart will eventually wind up in your bank.

Banks are obligated to report large or suspicious transactions to the government (without your knowledge). There’s also increasing pressure from regulatory bodies to provide more visibility into crypto transactions.

Governments are wising up. In the United States, the Internal Revenue Services has tax codes specifically related to cryptocurrencies.

Check out this guide for more information on the US tax scene.

My advice: Play it safe. Report your earnings, and pay your taxes.

Get help

Platforms like ZenLedger, Accointing, and Koinly can help you prepare your crypto taxes (and give you some peace of mind).16

NFTs for digital artists: the promises being made

Hang on, I can’t hear you over the deafening noise of the NFT HYPE MACHINE™. Let me just… flip this… off.

Wow. So much better. Now we can talk.

If you listen to the True Believers, you’ll hear a lot of promises being repeated:

NFTs give artists the power to monetize their work.

NFTs will make you rich.

NFTs eliminate middlemen.

NFTs allow you to avoid traditional art market forces.

Let’s tackle each one. Oh, and if you’re wondering when the skepticism will kick in, that would be now. 😎

“NFTs give artists the power to monetize their work.”

Strictly speaking, this is true.

If you’ve wrapped your head around ownership of digital artwork, and you can find people willing to buy into the idea as well—then you’re in business!

“NFTs will make you rich.”

Whoa whoa whoa, slow your roll there, chief.

I get it. It feels like a gold rush out there right now. You just have to be smart and quick, right? It’s yours for the taking.

Keep reading and see if you feel the same by the end of this guide…

“NFTs eliminate middlemen.”

In theory, this is true. In practice, it’s a lot more complicated.

Defining middlemen

In the traditional art world, middlemen are galleries, dealers, auction houses, curators, and basically anyone between the artist and a collector.

For NFTs, middlemen take the form of minting platforms and cryptoart marketplaces. Hypothetically, you don’t need them to create and sell cryptoart. You could just go it alone.

Going it alone (is lonely)

Just as a painter or sculptor can make and sell their work directly to anyone on the street, a cryptoartist could put their work up for sale on their personal website and wait for the cash to come rolling in.

Only… it wouldn’t.

How would people know about your work in the first place? How would they find it?

“I’d tell them on my socials.”

If you already have a massive network of highly interested collectors following you, then sure, that could work.

Chances are, you don’t.

“I could show them my work to grow my following.”

True. But that takes a while. Usually a very long while.

Beeple worked literally every day for over a decade with no breaks to rack up a million Instagram followers and become an “overnight” success.

You’re also at the whim of each social network’s algorithms and community quirks. Even though it may not feel like it, Twitter and Instagram are, in fact, middlemen. Social media platforms are gatekeepers to the NFT art world.

No platform, no recourse

Let’s imagine a scenario:

- You mint a new NFT: a rainbow-tinted cat with lightning bolts shooting from its eyes.

- You’re pretty pumped about it. This might be the one, your big NFT breakout moment.

- Instead of listing your NFT on a marketplace like Rarible or SuperRare, you decide to list it yourself on the open Ethereum blockchain. No middlemen in the way.

- You hype your NFT on your socials…

- …but it flops. No one even notices it.

- Two weeks later, you see your NFT for sale… by someone else. They copied your original and created a counterfeit NFT!

- Furious, you take to social media with the news.

- As before, no one cares.

- To make matters worse, the counterfeit NFT sells for $100k, and the new artist launches a successful cryptoart career off of its success. He now lives in an underwater volcano lair off the coast of Maui.

Far fetched? Maybe. But here’s the point:

Platforms provide protection

Most platforms allow you to report fakes and counterfeits. They have customer service representatives and a reputation to protect. It’s vital that they’re perceived as trustworthy marketplaces that treat artists (and collectors) well.

Their very existence depends upon it.

Platforms give you reach

It’s hard to sell art without collectors willing to pay for it. Like all marketplaces, cryptoart platforms bring together buyers and sellers.

Most platforms boost the visibility of the artists they believe in. They do this through homepage features, timed auctions, promoted listings, and plenty of social media chatter.

That kind of reach is hard to achieve on your own.

Platforms boost your art’s value

Imagine you’re a painter, and you make a painting. It’s great. Everyone likes it.

Now you have a choice:

- You can sell it in a well-regarded Chelsea gallery in New York City.

- You can sell it at the flea market out by the highway.

Which would you choose?

Maybe you’re an annoying contrarian, and you opt for the flea market. What do you think you’re going to fetch for your painting there? $100? $500?

There’s a limit to what people will pay for art at a flea market. (Spoiler alert: it’s not much.)

The gallery approach

Now, let’s say you make the sensible choice, and you go with the Chelsea gallery. They will plan a big opening, tell all their rich friends about it, order some Dom Perignon, and generally market the hell out of your art.

The night of your opening, everyone is worked into a frenzy over your work. They simply must have it. So the wallets come out and the green starts flying.

Who knows how high the prices will go?

Many cryptoart marketplaces are taking a similar approach. NiftyGateway's timed auctions (drops) are heavily hyped on social media and engineered to create that “opening night” excitement—along with the price tags that come with it.

“NFTs allow you to avoid traditional art market forces.”

Here’s a popular narrative:

The traditional art world is a notoriously difficult fortress to penetrate. With high walls financed by billionaires and protected by gallery owners and cultural institutions, it can seem impossible for aspiring artists to break into in the art world.

Once you’ve somehow made it inside, you must then grope your way through a dizzying maze of politics, ambition, treachery, and greed.

The value of your work is determined less by your creative genius and more by the people you know and the games you play.

Sound familiar?

If the narrative above sounds familiar to you, you’re probably very excited about the idea that NFTs can create a new, better art world, one in which art is valued for art’s sake and all artists are treated equally.

Okay, first let’s take a high-level look at traditional versus cryptoart markets.

Crunching some numbers

The traditional art market’s total value was roughly $67 billion USD around 2018.17

But what’s behind that number?

Works by 52,105 artists appeared at fine art auctions in 2017 according to the Art Basel and UBS’s The Art Market | 2018 report. But only 1% of those names accounted for 64% of the sales (works priced and sold higher than $1 million per pop).

According to the same report, nearly all artworks up to $1 million declined in value. On the contrary, the market for works priced over $1 million increased. The number of items sold in that segment grew by 76% along with the 50% value increase. / Source

Those numbers are… tough. The message is clear: If you’re not a superstar artist, don’t quit your day job.

And if you’re a collector, you need to spend big (over $1 million USD) for the best chances of making a return an your investment.

But what about cryptoart?

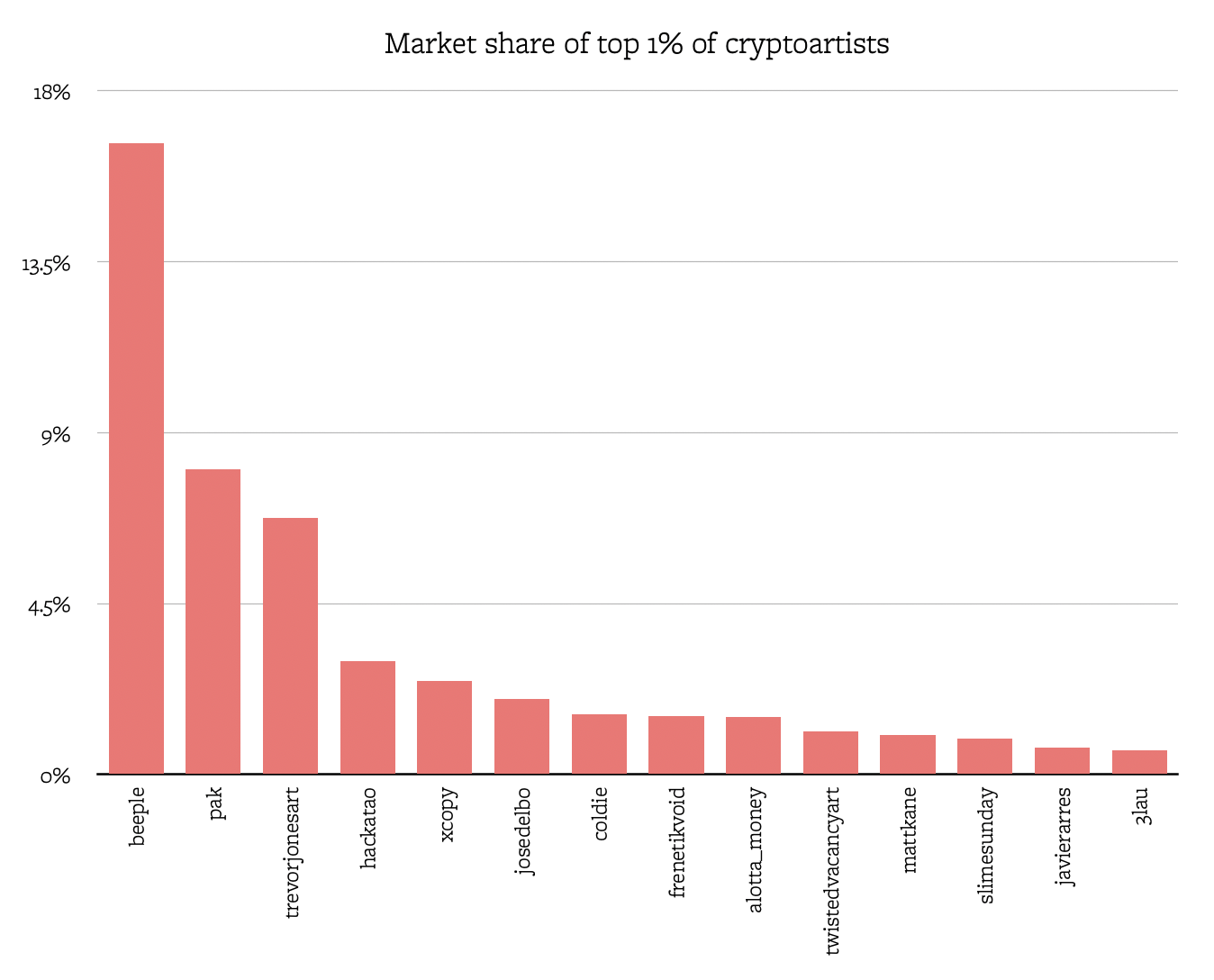

Top 1% grossing artists across SuperRare, Nifty Gateway, MakersPlace, Async Art, and KnownOrigin / Cryptoart.io

Top 1% grossing artists across SuperRare, Nifty Gateway, MakersPlace, Async Art, and KnownOrigin / Cryptoart.io

At the moment, there isn’t a comprehensive datasource covering the entire cryptoart market. Cryptoart.io comes close, though.

Out of 1,378 artists on SuperRare, Nifty Gateway, MakersPlace, Async Art, and KnownOrigin, the top 1% account for 48% of the total market share across those marketplaces (roughly $39 million USD at time of writing).

Beeple alone commands nearly 17% of the market. 😳

Across the entire group, the median total artwork value per artist is $3,114 USD while the average total artwork value is $28,305 USD. The massive gulf between those numbers indicates that the the highest value artworks are much more highly valued than the rest of the pack.

These numbers are not complete, but they give us an interesting peek into the cryptoart market as it currently stands.

Open to interpretation

At first glance, the cryptoart market seems to be as top-heavy and skewed towards superstardom as the traditional art market. A relative handful of artists dominate the playing field.

It’s not quite that simple, though.

The cryptoart market is young.

Cryptoart is in its infancy. It’s very difficult to say how large the space will grow and what shape it will take.

Art collecting is not a zero-sum game.

In both the traditional and crypto art worlds, the value of one artwork going up does not necessarily mean that other artworks must go down in value.

Theoretically, this means that the pool of successful artists can expand infinitely—as long as there are collectors willing to pay for their work.

Not everyone is trying to get rich.

With a median total artwork value of $3,114 USD per artist and a median of 8 artworks created by each artist, that comes out to roughly $389 per artwork.

Depending on how much time and effort you put into each piece, that’s not bad. It won’t pay the rent, but it might buy your groceries.

What drives modern art markets?

In the traditional art world, the most important factor in determining the value of artwork is the artist themselves.

Whether living or dead, an artist’s “hotness” has an outsized effect on the sales price of their work. Defining hotness and understanding how it develops is the central challenge of curators, critics, gallery owners, and institutions.

Collectors also influence hotness. By buying and selling works from a particular artist or movement, collectors can single-handedly drive up hotness (and therefore value) with just a few taps on their smartphones.

Alan Bramburger, author of The Art of Buying Art, says:

Some of the best barometers of hotness are how in-demand that art is, how fast it sells, how long the buyer wait-lists are, which famous collectors own it, how often they’re getting written about, and how difficult it is to find quality examples for sale.

Is cryptoart different?

Cryptoart is equally obsessed with hotness. Many of the factors that matter in the traditional art world also matter in the cryptoart world.

Successful cryptoartist Trevor Jones wrote the oft-cited “Artist Checklist for Success,” which includes 61 tips for getting ahead in the world of NFTs.

Here’s a curated selection of tips related to cultivating hotness (although Jones doesn’t call it that):

- Organise a solo or group physical art exhibition as you’ll learn important lessons, organisational skills, marketing, etc that will be transferable to the digital NFT world.

- Build your brand.

- Research marketing skills and apply them even if you hate this part.

- Generate publicity whenever possible.

- Network whenever you can.

- Build a crypto media email contact list.

- Make friends with crypto journalists.

- Learn how to write a good press release.

- Organise an exhibition or giveaway for charity.

- Show your work at crypto conferences.

“What about social networks? Aren’t they important?”

Yes, hugely important.

For example, curated NFT marketplaces (which often fetch the highest prices) are very interested in how many followers you have and how active you are in the cryptoart scene. The KnownOrigin artist application even includes required fields for Twitter and Instagram profiles.

While marketplaces will do their best to promote artists they believe in, they also rely on artists to promote themselves. The bigger your network and the more influence you have, the safer bet you are.

“Despite everything above, it still feels to me like cryptoart avoids traditional art market forces.”

Not convinced, eh?

Well, let’s see if we can settle on this compromise: The forces are similar, but the origins and importance of those forces are different.

“Seems like splitting hairs.”

Maybe.

The point is that the traditional art world and the cryptoart world are both marketplaces. And all marketplaces function on some basic, shared rules.

The mix of those rules might vary wildly, and a given marketplace might layer additional rules on top of the shared foundation.

But the quicker you learn the basics—and embrace their inescapability—the better off you’ll be in any environment.

Other questions

Why are so many NFTs ugly?

Because so much art is ugly.

What’s with all the memes and gimmicks?

Cryptoart is rooted in the world of cryptocurrency. At the time of writing, there are over 6,000 different cryptocurrencies.

Digital currencies are non-visual. They’re social constructs. You can’t see them or touch them. (Some of them you can definitely smell, though.)

It makes sense, then, that people who have something to gain look for “viral” ways to spread the gospel about their chosen cryptocurrency.

Enter the meme

Memes are by definition designed to be shared. They use a combination of in-jokes and cultural sampling to define and fortify communities that “get it.”

For better or worse, the NFT scene is hard to “get,” creating a mystique around it, an air of exclusivity. Memes are the secret handshakes that get you into the club.

But yeah: meme art is lame.

Can cryptoart auctions or marketplanes be gamed?

Sure. Just like any auction, price and demand can be manipulated by bad actors.

Thanks to the inherent anonymity of blockchain transactions, it’s easy for someone to, for example, make 30 bids from 30 different accounts to create aritificial demand for an NFT.

Similarly, NFT traders can artificially drive up value by “wash trading”—buying and selling something to/from yourself, making it look like that thing (an artwork, a collection, or an entire marketplace) is much hotter than it actually is.18

Can someone steal my cryptoart?

They’d need to get into your cryptowallet, and that should be difficult, provided you’ve taken the usual precautions. But it's definitely possible.

Can NFTs be used to launder money?

Sure, but there are probably better ways to do it. NFTs are volatile and often not as decentralized as more “pure” cryptocurrencies.19

What about the future of NFTs?

The underlying technologies of NFTs are in their infancy. As critical as some of the above writing above might sound, I’m excited about the future.

Whenever a new disruptive technology comes along, the first thing we do is try to recreate the preceding technology with it.

The early days of the internet, for example, were obsessed with reproducing printed matter. News sites looked like newspapers. Corporate sites looked like brochures.

Why do you think we call webpages “pages”?

Recreating the art world

The same thing is happening with NFTs. We’re trying to recreate the physical art world (and, I would argue, succeeding). Okay, fine. But that’s just the beginning.

Blockchains like Ethereum are capable of so much more. NFTs can be “smart.” They can respond to external forces and have lives of their own. Some artists and technologists are pushing these boundaries now, and I think we’re going to see a lot of innovation in the space over the next decade.

Come on, bubble, POP!

The True Believers will have my head for this, but I believe the current NFT craze is a bubble fueled primarily by speculative sharks looking to make some quick money.

There are definitely people who care about the art and artists, but I strongly suspect they aren’t the ones paying $66,666 for a single NFT. The bubble has been hyper-inflated by tech bros who are playing out a Ponzi scheme amongst themselves.

Once this bubble pops (or slowly deflates), we’ll settle into a baseline of activity, a new normal. That’s when the really interesting stuff starts. I believe there will be entirely new ways of making and monetizing art that open up sustainable career paths for artists.

Maybe.

I don’t know.

Go out there, and figure it out! I’ll be here, taking notes.

Further reading

General NFT info

Crypto taxes

- Frequently Asked Questions on Virtual Currency Transactions from the Internal Revenue Service

- Best Crypto Tax Software

Contact

Quibbles, questions, and kudos can be directed to me@justincone.com.

Follow on Twitter

Connect on LinkedIn

Changelog

This page will be updated as I become aware of new information—or when I change my mind about things.

2023.06.03

- Removed the energy usage warning from the top of the page, since Ethereum has switched to a proof of stake consensus mechanism. More info here.

- I also removed other references to Ethereum’s energy consumption.

2021.8.10

- After spending several months researching Ethereum and cryptoart energy usage, I removed links to problematic sources of information: Memo Atken’s Medium articles and Digiconomist’s Ethereum Energy Consumption Index. Both use imprecise models for predicting energy use and environmental impact per NFT.

- Updated the opening Beeple NFT sale to the more famous $69 million Christie’s auction.

- Updated the number of cryptocurrencies to over 6,000.

- Removed references to the European Union tax system, keeping things to just the US for now. (Thank you, Thomas Wiesner!)

2021.1.20

- Added a preface with a strident warning about the environmental impacts the current state of cryptoart.

2021.1.18

- Corrected the explanation of royalties in this section. (Thank you, ik80!)

- Added a warning about the environmental costs of the current cryptoart economy in this section. (Thank you, @mulmbot!)

2021.1.5

- Corrected the description of ZendVibes’ NFT product and included a YouTube video.

2021.1.3

- Rewrote entire sections to reflect the idea that a token and its accompanying media together are cryptoart.

- Added MakersPlace to list of popular marketplaces.

- Added Infinite Objects and Zendvibes to the Creating physical objects section. Thanks to []@BasedTime](https://twitter.com/BasedTime/status/1345712828892770305) for the tips!

2021.1.2b

- Based on some helpful feedback from obxium and Alpacawhal I edited the The token is not the thing section to more accurately describe the relationship between the token, its metadata, and the owner.

2021.1.2a

- Published to personal site

- Added Twitter and LinkedIn links

2020.12.24

- Added this changelog section 😄

Footnotes

They’re really more like giant databases. I’m trying to use terms that don’t scare people. “Database” scares people. “Spreadsheet” is less scary, and it’s close enough for our purposes. ↩︎

This is a massive oversimplification of blockchains. Want to really understand them? Go for it, my friend. ↩︎

For more on fungibility and NFTs, this is a good resource. ↩︎

What’s interesting about Ethereum is that it’s more than just a spreadsheet—it’s a global supercomputer. You can “program” the global computer of Ethereum using something called smart contracts. Read more here. ↩︎

“What most NFTs do is store the majority of data ‘off-chain’ where a URL of the data is pointed to the NFT on the blockchain. The problem is that the data behind the URL can change. This means that an NFT that was supposed to represent a specific piece of crypto art or maybe a game character can be altered without anyone knowing. This defeats the purpose of the NFT in the first place.” Source ↩︎

The InterPlanetary File System (IPFS) is one possible solution to the hosting problem. Kinda like BitTorrent, IPFS distributes file hosting across a network of decentralized computers. ↩︎

One way to prove that a linked media asset is indeed the “official” one is to use a system of hashes to compare them. ↩︎

Don’t get me wrong, it can be done. There are some cool technologies that can help, like embedding these devices in physical objects, but they won’t apply to all cases. Third parties (e.g. galleries or professional verifiers) can help… but then why are you messing with cryptoart in the first place? ↩︎

I am not a lawyer. This is not legal advice. ↩︎

No, I’m not getting paid by MetaMask. It’s just an excellent, free product. ↩︎

The geniuses behind Ethereum are working on a solution. But will it come fast enough? ↩︎

This is not an exhaustive list. Also, many of the most popular NFT marketplaces aren’t cryptoart marketplaces. Remember that NFTs can be any kind of digital collectible, including fantasy sports trading cards or virtual real estate exchanges. ↩︎

Royalties exist in many different industries, not just music. It’s an example, people. ↩︎

I don’t want to get too technical, but it’s worth pointing out that I’m specifically talking about ERC-721 tokens, which are the most popular Ethereum token types for NFTs. ↩︎

I say “seem to be working,” because crypto tax is a rapidly developing field. Things could literally change overnight. Also, did I mention I’m not a tax expert? ↩︎

No, I’m not being paid by any of them. ↩︎

Prepared by UBS and Art Basel, this yearly report is based on auctions, dealer sales, art fair sales, and online sales. ↩︎

Wash trading exists in many marketplaces, not just crypto. For more on why it matters, read this. ↩︎

Aside from occasionally speeding, I’m not a criminal. I apologize for my lack of knowledge in this area. 😎 ↩︎